Get the free osha 301 fillable - bls

Get, Create, Make and Sign osha 301 - bls

Editing osha 301 - bls online

How to fill out osha 301 - bls

How to fill out OSHA form 301 PDF:

Who needs OSHA form 301 PDF:

Instructions and Help about osha 301 - bls

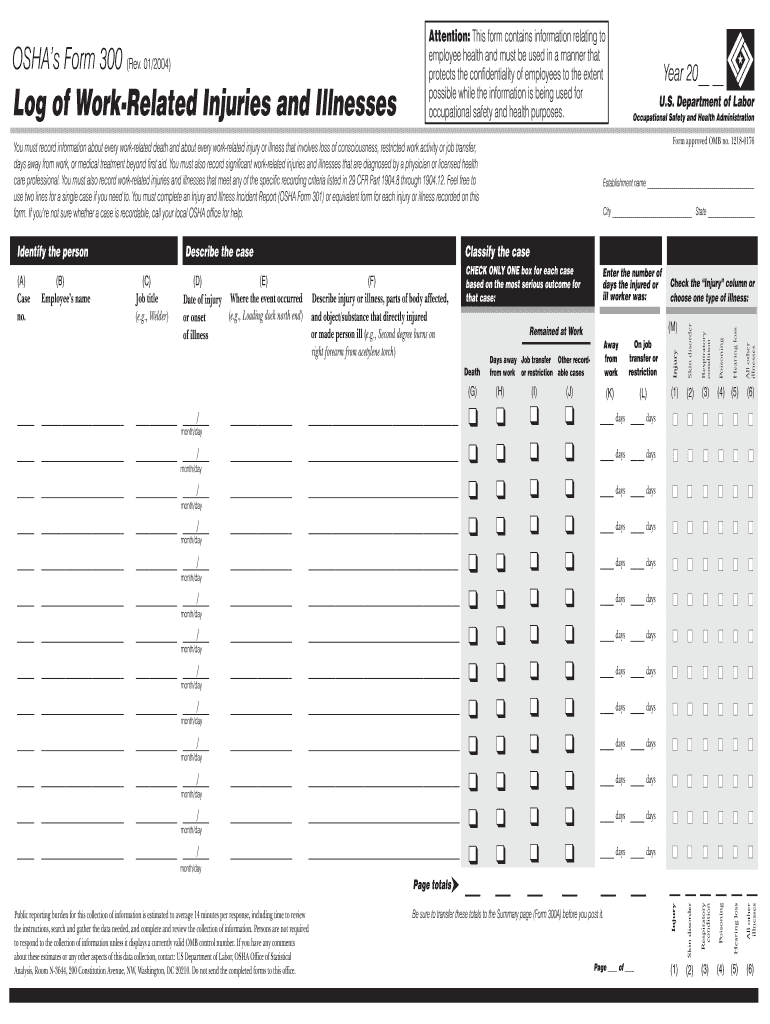

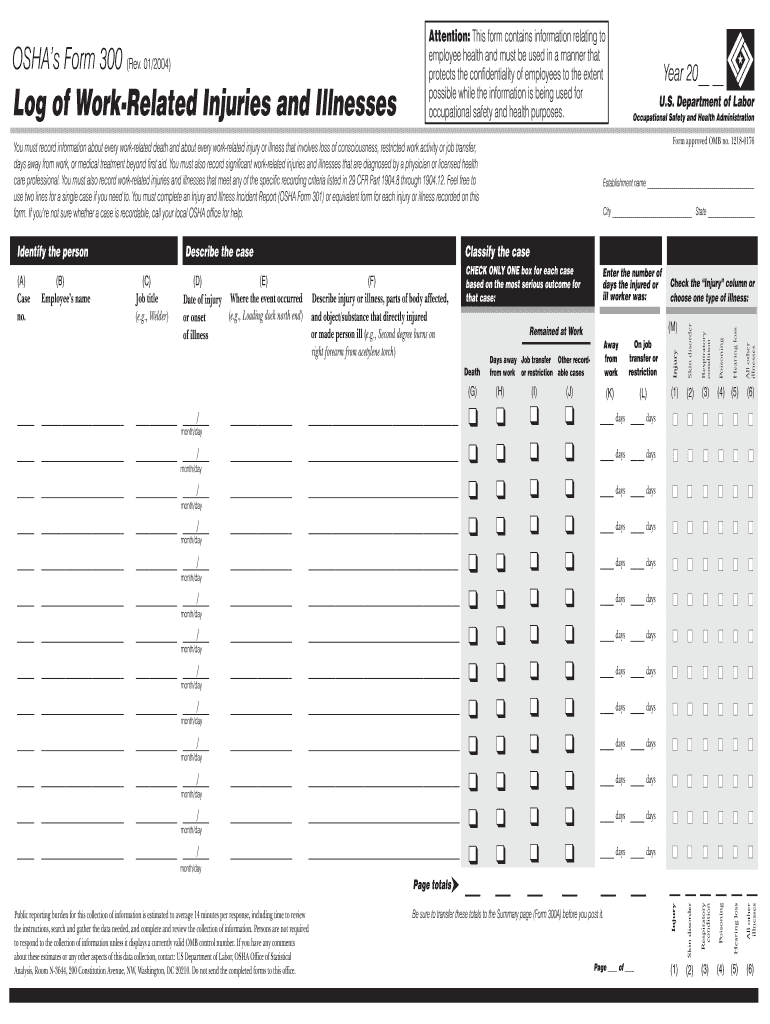

Welcome to the Montana Department of Labor in industry safety and health bureaus tutorial on completing OSHA record-keeping forms this presentation reviews OSHA record-keeping requirements with an emphasis on how to fill out the forms provided in OSHA's record-keeping forms package it covers what types of operations come under the record-keeping rule and are required to complete the forms what types of injury and illness incidents must be recorded and what information is to be included in each of the three OSHA forms it also contains a review of OSHA's record-keeping requirements to complete the forms and evaluate specific exceptions the three forms in OSHA's record-keeping package are the 300 log of work-related injuries and illnesses the 301 injuries and illnesses incident report and the 300 a summary of work-related injuries and illnesses you will learn the type of injuries and illnesses that must be recorded and how to record them on the forms not all employers must complete the record-keeping forms on an ongoing basis employers with 10 or fewer employees throughout the previous calendar year do not need to complete the forms the employer may come under the requirement only if there were more than 10 employees at any time during that calendar year when counting employees you must include full-time part-time temporary and seasonal workers this exemption is based on the employment of the entire company rather than each individual establishment for example if a company has two establishments one with five employees and one with seven employees the company must fill out the forms for both establishments because the company employment is greater than 10 the OSHA 300 and 301 forms must be maintained on an ongoing basis recordable injuries and illnesses must be entered within seven days of the occurrence on these forms throughout the year the OSHA Form 300 an is completed after the end of the year summarizing the number of recordable cases that occurred employers may use equivalent forms in place of these forms as long as they contain all the same data elements and are as easy to read as the OSHA forms once again all work-related injuries are illness that meets certain severity criteria must be entered on the forms OSHA defines an injury or illness is an abnormal condition or disorder injuries and illnesses include cases such as cuts fractures sprains skin diseases or respiratory conditions they can also consist of only subjective symptoms such as aches or pain exposures that do not result in any signs or symptoms are not considered injuries or illnesses and should not be documented on the OSHA forms for example if an employee is exposed to chlorine and does not exhibit any signs or symptoms due to the exposure the case would not be recorded on the log even if it involves preventive medical treatment such as a tetanus shot for a minor cut it's not an exposure unless it results in signs or symptoms cases that are caused contributed to or...

People Also Ask about

What is the OSHA 301 form?

What is OSHA form 301 injury and illness incident report?

What is an OSHA 301 incident report?

Who must fill out OSHA form 301?

What is the purpose of Form 301 injury and illness incident report?

What is the difference between an OSHA 300 300A 301?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit osha 301 - bls from Google Drive?

How do I make changes in osha 301 - bls?

How can I edit osha 301 - bls on a smartphone?

What is OSHA 301?

Who is required to file OSHA 301?

How to fill out OSHA 301?

What is the purpose of OSHA 301?

What information must be reported on OSHA 301?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.